Best Ways to Managing Your Church's Finance

“Quick Summary” “Accounting is the language of business” - Warren buffet, chairman and CEO of Berkshire Hathaway.

Preparing all the financial reports of the Church, financial statements, and managing payments and receivables can be overwhelming and is prone to mismanagement when done manually. We have been hearing several cases of embezzlement due to poor accounting systems in Churches.

A systematic digital accounting specifically designed for Church transactions holds great value in eliminating all the ambiguities associated with managing funds, charities, and taxation.

Churches receiving funds from various sources in the form of donations, grants, pledges, bequests, tithes, etc., for community development have to be more precise and accurate in managing funds to enhance the donors' trust. Less focused on profitability, it is imperative for church administrators to bring transparency in the accounting process to demonstrate that funds stewardship is done wisely.

Unlike traditional business enterprises, churches do not have owners' equity or stakeholders, and it is the shared responsibility of church authorities and trustees to manage funds more accurately and efficiently. This is possible only by investing in the best church accounting software.

Challenges Faced by Churches In Managing Accounting

Lack of Transparency

Churches that follow old-school accounting techniques for managing funds often end up with errors and wrong financial reports. Without a standard procedure to track or record revenue and expenses usually results in monetary loss.

Besides this, churches are liable for tax exemption, but traditional accounting practices do not give accurate revenue information. Misleading accounting information can result in filing tax exemption forms inaccurately and taking full advantage of it.

Financial Fraud

Inadequate information about the church’s financial elements can increase the risk of fraud and cheating. Small churches do not audit their financial records internally or externally, and therefore, financial fraud goes undetected. Church accounting should consider everything right from offerings, donations, expenses on fundraising campaigns, events, grants, investments, capitals, pledges, and so on.

Managing Multiple Accounts

Unlike profit organizations, churches don’t sell goods or services, and therefore, their accounting system is slightly different. It is based on “fund accounting,” in which funds are released towards a specific mission like scholarship programs, missionary work, humanitarian aid, etc.

For each mission, a dedicated account is allocated, and financial activities are recorded for that respective account. Managing and tracking funds for all these accounts is a time-consuming and complicated process.

High Error Rates

Churches relying on manual accounting practices are prone to errors like duplicate entries, omission error, and error of commission. A single error requires verification of entire transactions from start to finish which is a tedious task.

Multi-Location Accounting

Some large-scale churches are spread across the world, and managing the accounting process of all these churches is a mammoth task for authorities. They can face obstacles in processing payroll, monitoring expenses, filing tax exemption forms, etc., due to their geographical locations.

One Top Way to Manage Your Church Accounting Efficiently

Accounting in the churches is not just limited to tracking revenue and expenses efficiently but also to build the trust of the congregation or donors in the Church. Apart from implementing the accounting best practices and keeping a track of the GAAP rules, one top way to manage Church accounting is to invest in the best church accounting software.

Church accounting software can be instrumental in simplifying church accounting and managing donors' funds.

What Can Churches Accomplish With the Church Accounting System?

Managing Multiple Ledgers

Church accounting software is designed to meet the unique needs of churches. For instance, Churches have to allocate funds under various missions or activities, and for each activity, they have to manage a separate ledger. It is challenging to do with traditional accounting procedures, but church accounting software can make managing multiple ledgers easy. Users can create multiple ledgers and break them down into smaller subgroups to record transactions.

Bank Reconciliation

Church accounting software helps pastors or church leaders with bank reconciliation and make them vigilant on any discrepancies or errors taking place in recording financial transactions.

Automating Data Entry

The advancement in AI and OCR (Optical Character Recognition) technology helps to automatically capture data from invoices and other financial documents replacing manual data entry. It speeds up the accounting process and minimizes errors.

Data Analytics and Reports

Church accounting software provides a complete view of the church's financial status through reports and data analytics. Some software even gives the flexibility to customize the reports and generate them automatically. These reports are crucial to identify the gaps in the accounting process and fix them before they become worse.

Meeting Regulatory Compliance

Church accounting solution keeps users updated about industry rules and compliance. Church accounting software keeps a record of all regulatory compliance, and with real-time updates, there is zero risk of missing any of them.

Oversee the Payroll Process

Staff salaries, clergy allowances, benefits, deductions, etc., are expenses to the church, and recording them accurately is part of the accounting process. Church accounting tool with an in-built payroll feature or supporting third-party payroll integration can help users to automatically record payroll.

Features to Look In Church Accounting Software

- Standard accounting features(Account payable, account receivable, bank reconciliation, etc.)

- Third-party tool integrations

- Support for multiple currencies

- Organization-wide access

- Online payments

- Customized reports

- Payroll management

- Technical support

- Fund accounting with a general ledger

- Customized financial reports

- Tax and benefits

- Regulatory compliances

- Multi-user access

How to Find the Best Church Accounting Software Vendor

From bank reconciliation to payroll and recording financial details automatically, the church accounting software can handle any accounting task with ease. It keeps all the information consolidated and safe in a single place. There are a myriad of other elements that accounting software can help churches with, like fund transfers, journal entries, budgeting, etc.

On the other hand, donors can comprehend the financial position of the churches through financial reports generated by the software and make decisions on funding.

However, selecting the best church accounting software that caters the need of that particular church is critical to derive maximum value from it. Here are a few ways church authorities and pastors can use to shortlist the best church accounting software.

Read the Software Reviews and References: Reviews and feedback from real users is the best way to gauge the best accounting tool for churches. Platforms like GoodFirms authentically provide a range of software products with real customer reviews and ratings.

Community Forums: There are various community forums where users share their experiences and offer their suggestions on software products. Another way to find software products is to connect with experts or peers on social media platforms and take their views.

Visit Software Websites: Visiting software providers’ websites and checking their portfolios is also an ideal way to shortlist software solutions.

Subscribe to Technology Blogs, Podcasts, or Magazines: Technology blogs, podcasts, and magazines provide a lot of information about software products and vendors. By subscribing to these channels, users can have better ideas on various software products and whether it is applicable to your organization. Users can also attend subject-related virtual or in-person events to find out about software products.

Related Blog: Proven strategies for your church growth

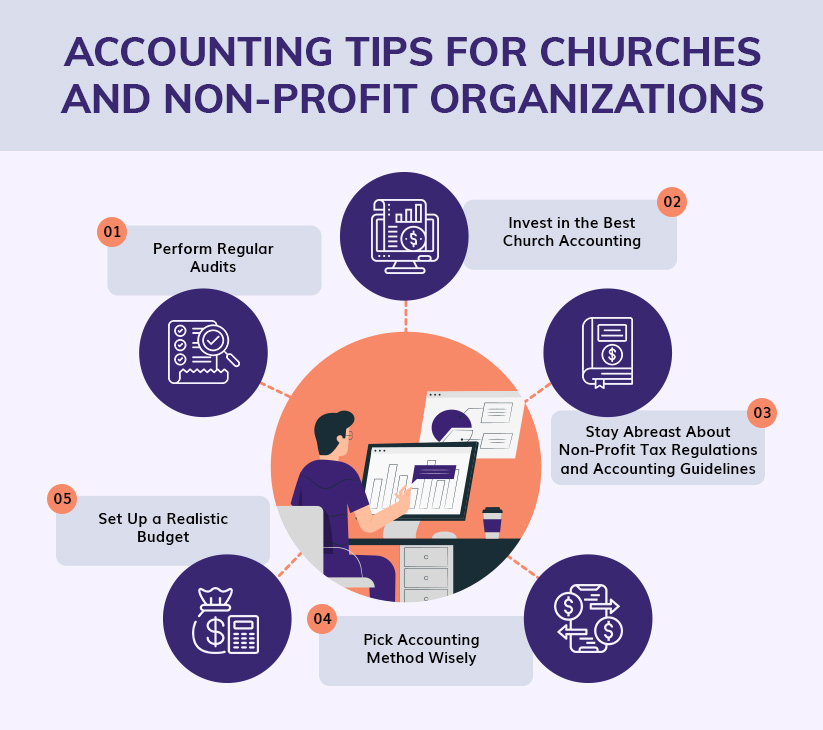

Accounting Tips for Churches and Non-Profit Organizations

Managing accounting in churches and nonprofit organizations is sometimes overwhelming due to its nature of functioning. In order to avoid errors in church accounting and streamline the process, here are a few useful tips for churches and nonprofit organizations.

Perform Regular Audits

Auditing is an important part of the accounting process, but some churches may find hiring an external person for auditing an overhead cost. They opt for an internal audit, usually done by a qualified person within the congregation. An internal audit is recommended when the focus is operational effectiveness and internal control.

But if the church is involved in complex financial activities like pension liabilities, annuities, etc., then an external audit is more preferable. The secret for clearing the audit is to regularly file all financial documents and receipts in an organized manner.

Invest in the Best Church Accounting Software

Keeping everything in one place, including payroll, bank reconciliation, financial statements, audit reports, payment details, etc., gives the church authority better control over the church finances.

The software's centralized data storage gives quick access to all documents and updates them in real time. Church accounting software is also helpful in reducing accounting mistakes by automating manual work.

Stay Abreast About Non-Profit Tax Regulations and Accounting Guidelines

Although churches are liable to be exempt from taxes, they need to comply with state payroll tax regulations. Besides this, there are particular forms that churches have to file in order to exempt taxes.

For instance, churches in the U.S. have to fill out Form W-2G if the church is sponsoring any gaming event. Make sure you are aware of all the non-profit tax regulations and exemption guidelines. The individual that is handling church accounting should have a good understanding of the IRS principles.

Pick Accounting Method Wisely (Accrual Basis/Cash Basis)

For large churches that deal with multiple assets and liabilities should consider an accrual basis for the accounting. It gives more accurate results of a company's financial status.

Small churches dealing with less complex transactions often use Cash basis because it is quite straightforward and does not need accounting expertise.

Set Up a Realistic Budget

Just because Churches are non-profit organizations does not mean there is no budget allocation. They have to deal with routine expenses like staff salaries, church maintenance, event expenses, buying equipment, etc., and with a clear annual budget, it is easy to disburse the fund and control the financial activities.

Related Blog: Boost your nonprofit organization with donatemo

Conclusion

Churches and nonprofit organizations involved in community and welfare activities often fail to operate at their full capacity due to poor planning, inconsistent budget, and lack of financial management. It is paramount for churches to become strategic in implementing accounting best practices so that they get better at utilizing funds and contribute more towards benevolent acts.

Emerging technologies and software solutions like church accounting software can streamline the chart of accounts and ensure accountability in church finance. The global accounting software market is projected to reach $70.2 billion by 2030.

Accounting tools are designed to facilitate church leaders with a broad perspective on their financial performance and freedom to accomplish their mission with zero mismanagement.